Latest News

In October 2023, the FCA confirmed the conclusion of its work on assessing priorities for future regulatory development via DP23/2. The FCA said:

"We have received detailed feedback on the ‘Direct2Fund’ proposition providing the option for investors to directly transact with an authorised fund when buying and selling units.

This offers an alternative to the current dealing model where fund managers buy and sell units on behalf of the fund and its investors. We will develop the proposal further in the medium term."

This follows our May 2023 response to the DP, alongside which we provided our analysis of the regulatory changes that may be necessary.

Direct2Fund ('D2F') is the optional, alternative investor-fund dealing model for UK funds.

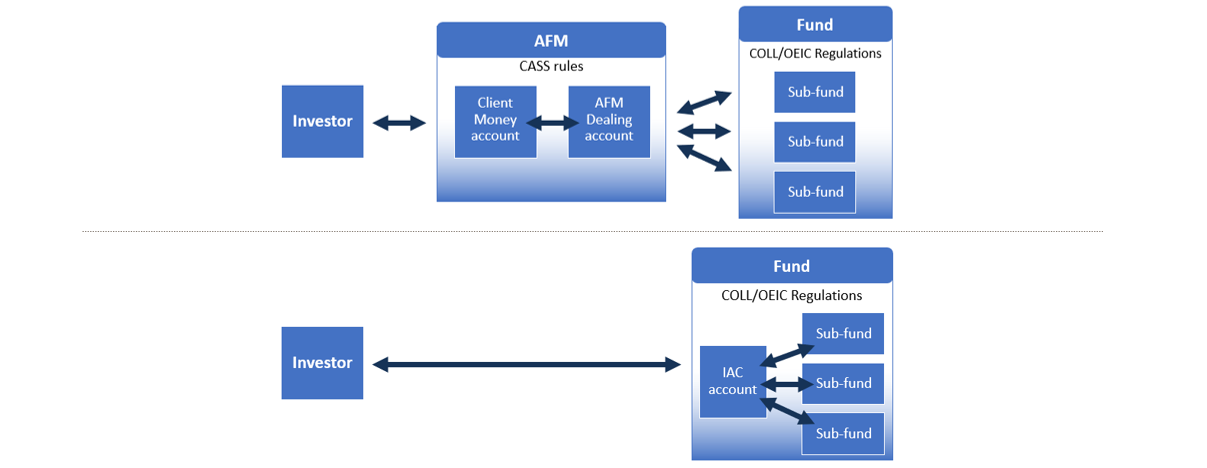

D2F enables investors to transact directly with their desired investment fund, bypassing the Authorised Fund Manager (AFM). The AFM has traditionally acted as a counterparty between investors and the funds they offer.

Removing the AFM from the chain:

- Replicates as much as possible the model operated in a number of non-UK fund domiciles (such as Luxembourg and Ireland);

- Eliminates completely the small risk of loss to the investor arising from a failure of the AFM (and remove the majority of the applicability of CASS);

- Bolsters the competitiveness of the UK investment management industry and delivers the best possible outcome for investors, business and the UK economy.

Adoption of the D2F model is intended to be optional and can run alongside the existing model.

This proposal originally formed a part of a wider set of initiatives from the:

- IA-led UK Fund Regime Working Group, looking at the future shape of the UK fund environment post-Brexit.

- Subsequently it has been noted by Treasury as something to be taken forward by the regulator and industry,

- and most recently the FCA has asked firms whether it should work towards consulting on rules to implement it.

Visual comparison

Publications

Regulatory & Legal Analysis, dated May 2023 - an executive summary of the regulatory changes that may be necessary to implement D2F

Update, dated March 2022 - provides updates on IA work and highlights the conclusions of an extensive legal and regulatory analysis, and intended next steps for the Direct2Fund initiative.

Contact

John Allan | Head of Innovation and Operations Unit