1 in 10 FTSE 350 companies fall short on gender diversity targets

Tuesday 17 April 2018

The Investment Association (IA) and the Hampton-Alexander Review have written to 35 FTSE 350 companies with low female representation at leadership level, calling for change.

14 companies in the FTSE 100 have been singled out. Companies in the FTSE 100 who have all-male Executive Committees, such as BP and Smurfit Kappa Group, and companies whose combined Executive Committees and Direct Reports have low proportions of women, such as Persimmon and TUI, have been asked to explain their poor gender balance and what steps they are taking to move towards the targets as set out in the Hampton-Alexander Review.

The Investment Association and the Hampton-Alexander Review have also written to 11 companies in the FTSE 250 who have all-male Boards, including Sports Direct and Stobart Group, and 10 companies who chose not to report their gender diversity data to the Hampton-Alexander Review last year, including The AA, J D Wetherspoon and Wizz Air.

As the trade body representing UK investment managers who collectively own one third of the FTSE and hold the UK’s biggest listed companies to account, the IA calls on businesses to take swift action. Investors want Boards and leadership teams to urgently address gender diversity. Diverse companies typically outperform their less diverse peers and make better long-term decisions.

Chris Cummings, Chief Executive of the Investment Association said:

"The body of research is clear: firms with a diverse management team and pipeline make better decisions and drive innovation. The target of 33% for women in senior leadership positions by 2020 absolutely aligns with investors’ desire to see the companies they invest in recognising diversity as a critical business issue.

“The Hampton-Alexander recommendations have now been in place since November 2016. Investors are becoming restless and want companies to take action.

“A number of key investors have told us that they will vote against AGM resolutions on the grounds of gender representation. With the AGM season now in full swing, companies who are falling short should take urgent steps to outline what they plan to do to increase diversity.”

Sir Philip Hampton, Chair of the Hampton-Alexander Review said:

“Whilst the majority of FTSE companies are taking great strides to address the lack of women on Boards and in their leadership teams, it is disappointing to see a significant minority of companies still making slow or no progress. The gap between those working hard to improve gender balance and those doing very little, has never been more obvious.

“All FTSE companies adrift from 33% women’s representation on their Boards and in leadership, need to rise to today’s challenge from the investment community and take swift action to address the lack of women in their top teams.”

Andrew Griffiths, Business Minister said:

“Diversity at the very top of businesses has proven time and again to make for more effective leadership.

“While some of the UK’s largest companies have made great strides in recent years to improve diversity in the boardroom, we need all FTSE 350 firms to pull their weight if we’re to become a world leader on gender diversity.”

-Ends-

Notes to the Editors:

- The Hampton-Alexander Review is an independent Government commissioned review which aims to increase the number of women in senior positions in FTSE 350 companies by 2020. When the Hampton-Alexander Review was established in 2016, it set five recommendations including the following targets:

- FTSE 350 companies should aim for a minimum of 33% women’s representation on their Boards by 2020.

- FTSE 100 and FTSE 250 companies should aim for a minimum of 33% women’s representation across their combined Executive Committee and the Direct Reports to the Executive Committee by 2020.

- The Hampton-Alexander Review gave an update on progress in a report published in November 2017: “FTSE Women Leaders – Improving gender balance in FTSE leadership: 2017 review”

- The Investment Association and the Hampton-Alexander Review wrote to the following FTSE 350 companies between Wednesday 11 April - Monday 16 April 2018:

- FTSE 100 companies which have an all-male Executive Committee as at 30 June 2017: BP PLC; Fresnillo PLC; Mediclinic International PLC; Provident Financial PLC*; Smurfit Kappa Group PLC; St James’s Place PLC.

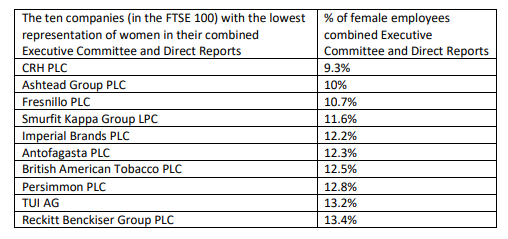

- The ten companies (in the FTSE 100) with the lowest representation of women in their combined Executive Committee and Direct Reports, as at 30 June 2017 (the Hampton-Alexander target is 33%):

- FTSE 250 companies who chose not to respond to the Hampton-Alexander Review data request in 2017: The AA PLC; CLS Holdings PLC; Grafton Group PLC; Marston’s PLC; Melrose Industries PLC; SSP Group PLC; Telecom Plus PLC; J D Wetherspoon PLC; WH Smith PLC; Wizz Air Holdings PLC.

- FTSE 250 companies who have all-male Boards as at April 2018: Daejan Holdings PLC; Sports Direct International PLC; Stobart Group PLC; TBC Bank Group PLC; Vietnam Enterprise Investment LTD; TI Fluid; Herald Investment Trust; PureCircle LTD, Baille Gifford Japan Trust PLC (The); JPMorgan Japanese Investment Trust PLC; On The Beach Group PLC.

- *Provident Financial PLC was in the FTSE 100 as at 30 June 2017.

For media enquiries:

Anisha Patel, Head of Communications: [email protected]

T +44 (0)20 7269 4635

Helen Ayres, Media Relations Manager: [email protected]

T +44 (0)20 7269 4696, M +44 7508 724066

About the Investment Association:

- The IA champions UK asset management, supporting British savers, investors and businesses. Our 240 members manage £6.9 trillion of assets and employ 93,500 people across the UK.

- Our mission is to make investment better. Better for clients, so they achieve their financial goals. Better for companies, so they get the capital they need to grow. And better for

- the economy, so everyone prospers.

- Our purpose is to ensure investment managers are in the best possible position to:

- Build people’s resilience to financial adversity

- Help people achieve their financial aspirations

- Enable people to maintain a decent standard of living as they grow older

- Contribute to economic growth through the efficient allocation of capital.

- The money our members manage is in a wide variety of investment vehicles including authorised investment funds, pension funds and stocks and shares ISAs.

- The UK is the second largest investment management centre in the world, after the US and manages 37% of all assets managed in Europe.

For further information, please contact:

For media, to receive the full consultation document, please contact Helen Ayres

Helen Ayres, Communications Manager: [email protected]

T +44 (0)20 7269 4620; M +44 (0)7508 724 066

IA press office: [email protected]

About the Investment Association (IA):

- The IA champions UK asset management, supporting British savers, investors and businesses. Our 250 members manage £7.7 trillion of assets and the asset management industry supports 100,000 jobs across the UK.

- Our mission is to make investment better. Better for clients, so they achieve their financial goals. Better for companies, so they get the capital they need to grow. And better for the economy, so everyone prospers.

- Our purpose is to ensure investment managers are in the best possible position to:

- Build people’s resilience to financial adversity

- Help people achieve their financial aspirations

- Enable people to maintain a decent standard of living as they grow older

- Contribute to economic growth through the efficient allocation of capital.

- The money our members manage is in a wide variety of investment vehicles including authorised investment funds, pension funds and stocks and shares ISAs.

- The UK is the second largest investment management centre in the world, after the US and manages 35% of all assets managed in Europe.