IA’s Velocity Accelerator opens its doors to establish the first cohort of FinTech innovators

Wednesday 18 July 2018

The Investment Association (IA) has today opened its doors to establish the first cohort of ground-breaking innovators for Velocity, the IA’s specialist FinTech accelerator for the asset management industry.

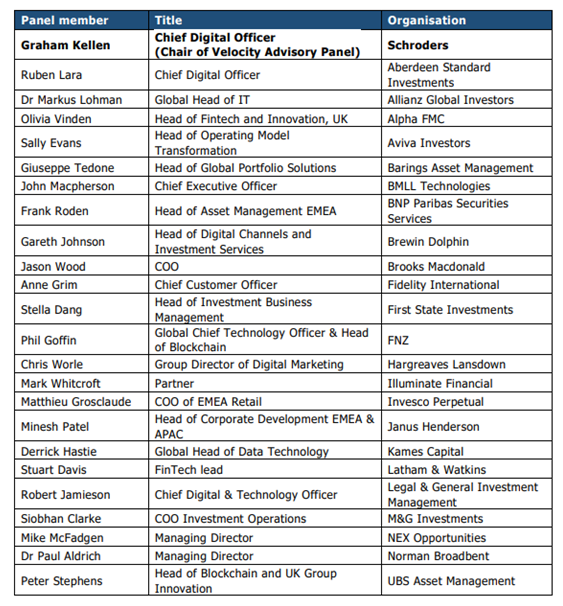

The 24-strong Velocity Advisory Panel, chaired by Graham Kellen, Chief Digital Officer of Schroders, and comprised of senior industry leaders and digital technology specialists, will oversee the selection process and meet for the first time today. Covering all aspects of the investment value chain, the expert Advisory Panel, will also provide guidance on the adoption of emergent technology across front, middle and back office operations.

FinTech firms with market-viable technology are being invited to apply to participate in the IA’s FinTech accelerator programme through the Velocity website by September 28, as the asset management industry seeks innovative new technological solutions to increase business efficiency and enhance customer experience.

During the six month programme, the first cohort of up to 10 firms will benefit from unparalleled access to the IA and industry expertise, as well as gaining valuable exposure to industry networks and potential clients. Participants will also benefit from access to a bespoke co-working space and mentoring from the Advisory Panel. The first cohort will be in place to start on the Velocity programme by October 2018.

As part of the drive to increase market engagement and awareness, the IA has also created an entirely new category of membership to accommodate the specific needs of FinTechs operating within asset management and the wider buyside market. FinTech membership will not only enable firms to access the IA’s comprehensive resources, but also participation in a structured programme of industry events. Uniquely, the IA will be issuing a new IA FinTech Member mark which recognises their specific market focus and association with the IA, setting them apart as a ‘company to watch’.

Commenting on the search for the first cohort, Chris Cummings, Chief Executive of the Investment Association, said:

“The UK has a strong pool of talented FinTech firms whose solutions are key to driving innovation across the asset management industry and ensuring that we remain globally competitive. Velocity will unlock the potential of these firms to implement their solutions within our industry, which is ultimately to the benefit of savers and investors. We have brought together for the first time a market-defining Advisory Panel which is truly representative of the asset management industry to ensure that we are selecting and developing the top talent.”

Graham Kellen, Chief Digital Officer, Schroders and chair of the Velocity Advisory Panel commented:

“The IA’s Velocity initiative is a critical step forward for the Asset Management industry, I am honoured to be so closely involved in the advisory panel and look forward to working with industry and FinTech ecosystem peers in selecting the most interesting start-ups to be part of the first cohort. The timing is perfect as members are now embracing the rapid technological innovation and are keen to accelerate the adoption of enhanced tools and cutting edge technologies for the creation of new products and services, moving the industry forward at the pace that reflects market dynamics and our customers’ needs”

Supporting the initial announcement on the creation of Velocity, John Glen, Economic Secretary to the Treasury and City Minister said:

“The UK is a world leader in asset management, but to stay that way we’ve got to keep ahead of the curve. There are over 93,500 people employed in the UK’s asset management sector, so the FinTech Accelerator - the first of its kind for the sector - will be fantastic news to them and to future entrepreneurs hoping to crack the market.”

-Ends-

Notes to Editors:

Velocity Advisory Panel Members:

To find out more and to apply for IA FinTech membership & the Velocity accelerator programme visit: www.IAVelocity.com

For enquiries on IA FinTech membership and Velocity applications:

Gillian Painter, Head of Membership: [email protected]

T: +44 (0)20 3859 0748

For media enquiries:

Helen Ayres, Media Relations Manager: [email protected]

T +44 (0)20 7269 4696

About the Investment Association:

- The IA champions UK asset management, supporting British savers, investors and businesses. Our 240 members manage £6.9 trillion of assets and employ 93,500 people across the UK.

- Our mission is to make investment better. Better for clients, so they achieve their financial goals. Better for companies, so they get the capital they need to grow. And better for

- the economy, so everyone prospers.

- Our purpose is to ensure investment managers are in the best possible position to:

- Build people’s resilience to financial adversity

- Help people achieve their financial aspirations

- Enable people to maintain a decent standard of living as they grow older

- Contribute to economic growth through the efficient allocation of capital.

- The money our members manage is in a wide variety of investment vehicles including authorised investment funds, pension funds and stocks and shares ISAs.

- The UK is the second largest investment management centre in the world, after the US and manages 37% of all assets managed in Europe

For further information, please contact:

For media, to receive the full consultation document, please contact Helen Ayres

Helen Ayres, Communications Manager: [email protected]

T +44 (0)20 7269 4620; M +44 (0)7508 724 066

IA press office: [email protected]

About the Investment Association (IA):

- The IA champions UK asset management, supporting British savers, investors and businesses. Our 250 members manage £7.7 trillion of assets and the asset management industry supports 100,000 jobs across the UK.

- Our mission is to make investment better. Better for clients, so they achieve their financial goals. Better for companies, so they get the capital they need to grow. And better for the economy, so everyone prospers.

- Our purpose is to ensure investment managers are in the best possible position to:

- Build people’s resilience to financial adversity

- Help people achieve their financial aspirations

- Enable people to maintain a decent standard of living as they grow older

- Contribute to economic growth through the efficient allocation of capital.

- The money our members manage is in a wide variety of investment vehicles including authorised investment funds, pension funds and stocks and shares ISAs.

- The UK is the second largest investment management centre in the world, after the US and manages 35% of all assets managed in Europe.