Page updated

The Targeted Absolute Return sector contains funds that aim to deliver positive returns in any market conditions, but returns are not guaranteed. So investors can distinguish between funds classified to this sector, funds must clearly state their objective and the timeframe to meet it. According to our definition for this sector, this should not be more than three years.

However, individual fund objectives will vary and we recognise there’s a wide expectation among consumers and advisers that funds in the Targeted Absolute Return sector will aim to produce positive returns after each year.

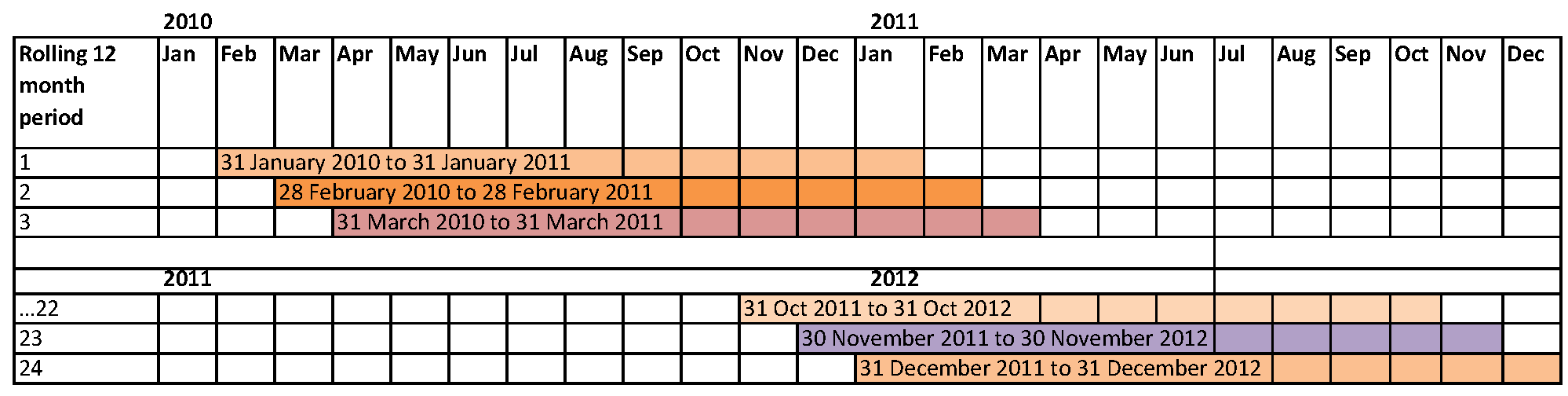

As such, we provide a monthly figure for each fund in the sector, showing how many times a fund failed to provide returns greater than zero after charges for rolling 12-month periods.

A rolling 12-month period means any consecutive 12 months. Our monitoring uses up to 24 data points, depending on when the fund launched. For those recently launched funds, we monitor over the available period. Click the graphic below to see how the monitoring of 12-month rolling periods work for an individual fund if monitoring started in December 2012.

Targeted Absolute Return Funds – Rolling 12 month Performance Data

We use performance data from Morningstar to monitor funds, and we update the previous month’s performance data on the second Monday of every month.

Targeted Absolute Return sector definition

Funds managed with the aim of achieving positive returns in any market conditions, but returns are not guaranteed.

Funds in this sector may aim to achieve a return that’s more demanding than a ‘greater than zero after fees objective’.

Funds in this sector must clearly state a timeframe to meet their stated objective. This allows the IA and investors to distinguish between funds by timeframe. The timeframe must not be more than three years.

Notes:

1. The sector includes a wide range of different types of fund targeting a positive return in any market conditions. Asset selection is at the discretion of the manager. Funds will employ diverse investment strategies designed to deliver a variety of outcomes, and will often use derivatives within the investment process. Amongst other things funds may use different benchmarks, manage to different timeframes and present different risk characteristics. For these reasons, performance comparisons across the whole sector are inappropriate.

2. Investors should satisfy themselves that they understand what any given fund is doing – and take advice if they are not sure. The Investment Association provides additional information through its website on each fund in the sector. This is intended to assist investors to narrow down the broad universe of funds in the sector by applying search filters of their own choosing, including timeframe.

3. Returns are made in the base currency of the fund. Investors may be subject to currency losses should the base currency of a fund be different to their domiciled/invested currency. Currently, only funds that are trying to achieve a return in Sterling may be classified to the sector.

4. Subject to satisfactory compliance with the sector definition, funds are classified to and remain in the sector on the basis of self-election by firms. It is the responsibility of the firm to ensure that any funds in the sector are correctly classified and not better suited to another sector. The determination that firms should apply is that any fund in the sector should be more like-for-like with the objectives set out in the definition than they would be in any other sector.

5. The Sectors Committee retains the right to move funds that appear to be incorrectly classified.

6. In a figure that will be refreshed monthly, the Investment Association will record on its website how many times over the preceding 24 months, a fund has failed to deliver a positive return over rolling 12 month periods. [For funds that do not have the 36 month track record necessary, the figure will show how many rolling 12 month periods have failed to deliver a positive return since launch and the total number of months since launch when a figure could be calculated].

7. The Investment Association will monitor the sector closely with a view to:

a. Determining whether groupings of funds with sufficient communality of objective and timeframe are large enough to merit the creation of sub-sectors where sub-sector performance comparisons and averages may be appropriate

b. Determining whether there should be rules that lead to the exclusion of funds from the sector on historic performance grounds.