Fund markets dip in 2018 as savers react to uncertainty

For immediate release: Thursday 7th February 2019

The Investment Association (IA), the trade body that represents UK asset managers, has today published figures on how savers invested in 2018:

- Net retail sales for 2018 were £7.2 billion, in comparison to £48.5 billion in 2017

- UK equity funds saw net retail outflows of £4.9 billion in 2018.

- Global was the best-selling sector of 2018 with net retail sales of £3.9 billion

Chris Cummings, Chief Executive of the Investment Association, said:

“Savers faced a perfect storm of political and economic uncertainty during 2018 leading to a sharp drop in retail fund sales. With investor confidence dented, the fund market experienced a dip, ending the year with £1.15 trillion funds under management.”

“UK equities were particularly hard hit, with savers reacting to the ongoing Brexit uncertainty by pulling out £4.9 billion in 2018. As the clock ticks towards the UK leaving the EU, asset managers and the millions of savers who rely on them are looking for greater certainty. It is critical that every effort is now made to find a constructive path forward that protects Europe’s savers and investors from the cliff edge effects that a no-deal Brexit could bring.”

FUNDS UNDER MANAGEMENT AND NET SALES

* The figures presented in the press release are aggregated for January - December 2018. To view December’s figures separately, see Notes to Editors.

2018 YEAR IN REVIEW ANALYSIS

2018 was a year characterised by political and economic uncertainty, with retail investors’ appetite knocked by a range of factors including: Brexit, US-China trade tensions, the dramatic slide in the Turkish Lira, and the Italian budget crisis. In this challenging climate, the fund market ended 2018 with £1.15 trillion funds under management, a contraction of 6.6% since 2017.

In contrast to the unprecedented record monthly net retail sales of 2017, 2018 saw mostly reduced inflows, with significant monthly outflows in the last quarter. These outflows were mainly driven by investors selling out from fixed income funds in the last three months of the year.

This bond sell-off was likely triggered by the anticipated end of quantitative easing in Europe, with the European Central Bank announcing the end of its bond-buying programme in December. Investors may also have acted on the US Federal Reserve signalling its intention for further rate rises following August’s increase, while also reducing its bond holdings.

Outflows were partly driven by equity funds as well. The impact of Brexit uncertainty was demonstrated in the large outflows from UK equity funds, with savers selling out each month in 2018. In the 31 months since the referendum, UK equity funds experienced outflows of £11.5 billion, compared to inflows of £5.6 billion in the 31 months preceding the referendum.

European equity funds suffered a similar fate in the second half of the year, with monthly outflows from May onwards. In contrast, Global, Asia and North America equity funds remained popular with investors throughout the year, until December when all experienced outflows. Global equity was the best selling sector in six months out of twelve and overall during the year, suggesting that savers were looking to diversify risk across regions.

Savers’ preference for risk diversification was also evident in sales for mixed asset funds; the only asset class that consistently attracted monthly inflows in 2018. It was further reflected in the continued positive sales of Volatility Managed funds, which proved to be the most popular type of outcome oriented funds. On the other hand, the Targeted Absolute Return sector experienced several months of outflows, particularly in the last quarter.

2018 BEST SELLING INVESTMENT ASSOCIATION SECTORS

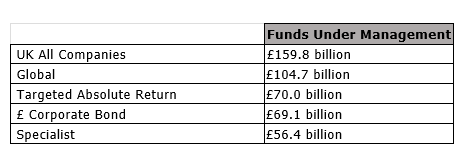

The five best-selling Investment Association sectors for 2018 were:

- Global was the best-selling sector with net retail sales of £3.9 billion.

- Mixed Investment 40-85% Shares with net retail sales of £3.3 billion.

- Volatility Managed with net retail sales of £1.7 billion.

- Mixed Investment 20-60% Shares with net retail sales of £1.5 billion.

- Asia Pacific Excluding Japan with net retail sales of £1.3 billion.

The worst-selling Investment Association sector in 2018 was UK All Companies with an outflow of £3.9 billion.

INVESTMENT ASSOCIATION SECTORS BY FUM

ASSET CLASSES

Mixed Asset was the best selling asset class in 2018, with £7.9 billion in net retail sales.

The second best selling asset class was Equity with net retail sales of £967 million.

The third best selling was Money Market, followed by Property, with inflows of £514 million and £255 million respectively.

Funds classified as Other (which includes the Targeted Absolute Return, Volatility Managed, Protected and Unclassified sectors) saw outflows of £346 million, while Fixed Income saw net retail outflows of £2 billion.

NET RETAIL SALES OF EQUITY FUNDS BY REGION*

Global funds were the best-selling in 2018 with net retail sales of £2.5 billion.

Asian funds were the next best-selling with net retail sales of £1.4 billion.

Japanese and North American funds were tied third best-selling with net retail sales of £1.2 billion for each.

Meanwhile, Europe and UK equity funds saw net retail outflows, of £1.3 billion and £4.9 billion respectively.

NET RETAIL SALES BY DISTRIBUTION CHANNEL

In 2018, net retail sales for UK fund platforms totalled £12.6 billion (£23.7 billion in 2017).

Other Intermediaries, including UK IFAs, achieved net retail sales of £149 million (£15.7 billion in 2017).

Direct net retail sales in 2018 were -£2.6 billion (-£752 million in 2017).

FUND PLATFORM PRODUCT SALES

The five fund platforms that provide data to The Investment Association (AEGON, Fidelity, Hargreaves Lansdown, Old Mutual Wealth and Transact) saw net sales of £8.9 billion in 2018.

Personal Pensions had net sales of £6.8 billion, Unwrapped £698 million and ISAs £1.3 billion, while Insurance Bonds saw a net outflow of £33 million.

For the same five fund platforms, funds under management as of the end of 2018 were £256 billion, compared with £261 billion at the end of 2017.

TRACKER FUNDS

Tracker funds experienced net retail inflows of £8.9 billion in 2018. Funds under management for trackers funds totalled £181 billion at the end of 2018. Their overall share of industry funds under management was 15.7%.

ETHICAL FUNDS

Ethical funds experienced net retail inflows of £1.3 billion in 2018. Funds under management at the end of 2018 were £15.9 billion, representing a 1.4% share of industry funds under management.

-ENDS-

For further information, please contact:

Helen Ayres, Media Relations Manager: [email protected]

T +44 (0)20 7269 4620; M +44 (0)7508 724 06

David Parton, Communications Executive: [email protected]

T +44 (0)20 7831 0898

Notes for Editors

To see a breakdown of the data referenced in this press release, please see all of the tables here.

The Investment Association's figures for fund sales cover retail and institutional sales in authorised unit trusts and open ended investment companies (OEICs) provided by our membership to UK investors. The figures do not include investment trusts and ETFs.

Each month small revisions to figures have been made since the previous press release. This reflects additional information received by The Investment Association.

Net retail sales comprise total retail sales minus repurchases (including switches between funds), thus the figures can result in a negative figure or outflow.

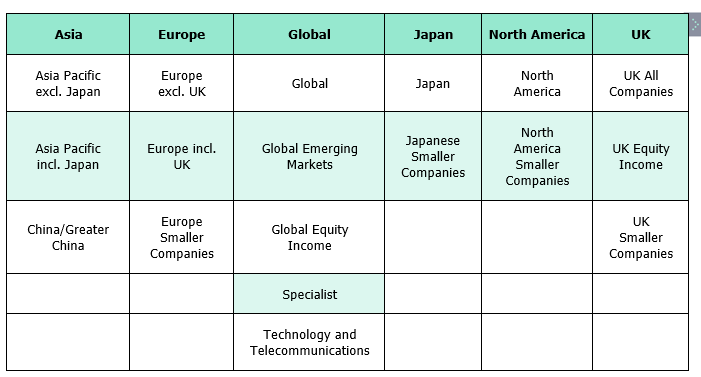

* Regional breakdown for equity funds

The following Investment Association sectors have been grouped together to compile the figures for regional equity sales:

Direct Channels

Direct includes sales forces and tied agents, private clients and other direct to investor sales without intermediation.

** The Investment Association’s ISA figures are based on information collected from fund companies and five fund platforms (AEGON, Fidelity, Hargreaves Lansdown,

Old Mutual Wealth and Transact) where they are the ISA provider. Fund business through other ISA providers such as wealth managers is not included. The Investment Association’s figures cover about three-quarters of the whole of the market for funds held in ISAs.

About the Investment Association:

The IA champions UK asset management, supporting British savers, investors and businesses. Our 250 members manage £7.7 trillion of assets and the asset management industry supports 100,000 jobs across the UK.

Our mission is to make investment better. Better for clients, so they achieve their financial goals. Better for companies, so they get the capital they need to grow. And better for the economy, so everyone prospers.

- Our purpose is to ensure investment managers are in the best possible position to:

- Build people’s resilience to financial adversity

- Help people achieve their financial aspirations

- Enable people to maintain a decent standard of living as they grow older

- Contribute to economic growth through the efficient allocation of capital.

The money our members manage is in a wide variety of investment vehicles including authorised investment funds, pension funds and stocks and shares ISAs.

The UK is the second largest investment management centre in the world, after the US and manages 35% of all assets managed in Europe.

For further information, please contact:

For media, to receive the full consultation document, please contact Helen Ayres

Helen Ayres, Communications Manager: [email protected]

T +44 (0)20 7269 4620; M +44 (0)7508 724 066

IA press office: [email protected]

About the Investment Association (IA):

- The IA champions UK asset management, supporting British savers, investors and businesses. Our 250 members manage £7.7 trillion of assets and the asset management industry supports 100,000 jobs across the UK.

- Our mission is to make investment better. Better for clients, so they achieve their financial goals. Better for companies, so they get the capital they need to grow. And better for the economy, so everyone prospers.

- Our purpose is to ensure investment managers are in the best possible position to:

- Build people’s resilience to financial adversity

- Help people achieve their financial aspirations

- Enable people to maintain a decent standard of living as they grow older

- Contribute to economic growth through the efficient allocation of capital.

- The money our members manage is in a wide variety of investment vehicles including authorised investment funds, pension funds and stocks and shares ISAs.

- The UK is the second largest investment management centre in the world, after the US and manages 35% of all assets managed in Europe.